What is Stamp Duty?

Stamp Duty is a tax applied when buying a property above a certain price threshold in England and Northern Ireland. The amount owed is determined by the property's purchase price.

The point at which Stamp Duty applies depends on whether you are a first-time buyer or an existing homeowner.

As of April 1, 2025, significant changes to the UK's Stamp Duty Land Tax (SDLT) have come into effect, impacting homebuyers across England and Northern Ireland. These adjustments mark the end of the temporary measures introduced in September 2022 and a return to previous thresholds.

Key Changes to SDLT:

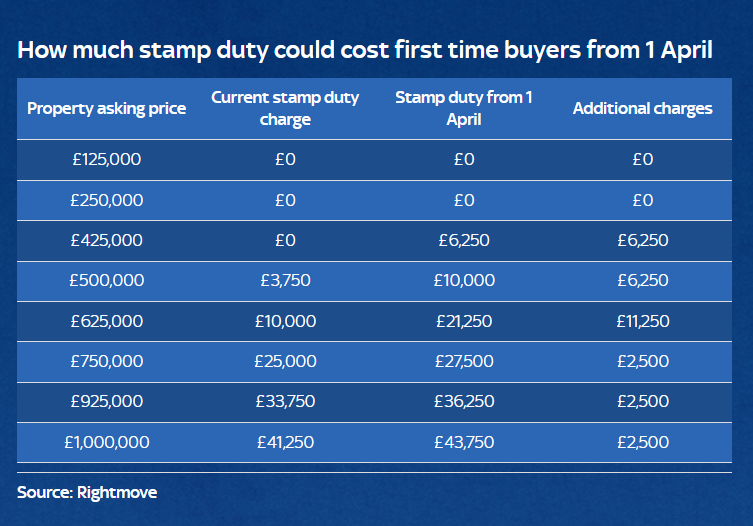

For First-Time Buyers:

o The 0% SDLT threshold has decreased from £425,000 to £300,000.

o Properties priced between £300,001 and £500,000 now incur a 5% SDLT rate.

o Homes above £500,000 no longer qualify for first-time buyer relief and are subject to standard rates.

Example: Previously, a first-time buyer purchasing a £400,000 property paid no SDLT. Under the new rules, the same purchase incurs a £5,000 SDLT charge.

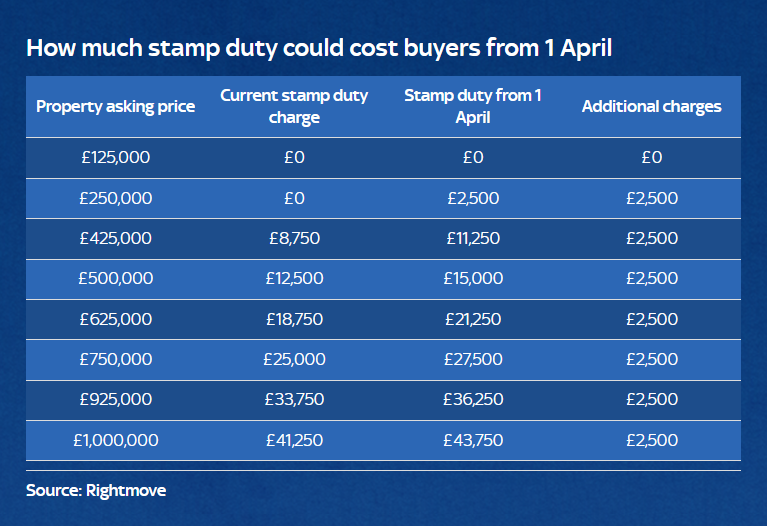

For Home Movers:

o The 0% SDLT threshold has reverted from £250,000 to £125,000.

o The portion from £125,001 to £250,000 is taxed at 2%.

o The portion from £250,001 to £925,000 is taxed at 5%.

o 10% on the portion between £925,001 and £1.5m, and even further to 12% on the remaining amount.

Example: Purchasing a £350,000 home now results in a £7,500 SDLT charge, compared to £5,000 before April 1, 2025.

For Additional Property Purchases:

• If you are buying a second home, you will be charged an extra 5% on top of the standard stamp duty rates.

• The 5% surcharge also applies if your main home is abroad and your second home is in the UK, and if your second home is bought through a limited company.

Example: Buying a £350,000 additional property now incurs a £16,500 SDLT charge, up from £14,500 prior to the changes.

Impact on the Housing Market:

These changes have led to a surge in property transactions as buyers aimed to complete purchases before the April 1 deadline. This rush contributed to steady house price growth in March, with the average UK house price reaching £271,316, a 3.9% annual increase.

Considerations for Homebuyers:

• Financial Planning: It's crucial to factor in the increased SDLT costs when budgeting for a property purchase.

• Market Dynamics: Anticipate potential shifts in the housing market due to these tax changes.

• Professional Advice: Consult with mortgage brokers and conveyancers to navigate these changes effectively.

Can you add stamp duty to your mortgage?

You may have the option to secure extra funds to help cover the Stamp Duty at completion. However, this would likely result in higher monthly repayments and increased interest costs over the loan term. It’s important to explore your options with your mortgage broker in advance.

Understanding these SDLT adjustments is essential for anyone considering purchasing property in the current market. Staying informed and seeking professional guidance can help mitigate the financial impact of these changes.

SPEAK TO AN ADVISER

Think carefully about securing other debts against your home. Your home or property may be repossessed if you do not keep up repayments on your mortgage or any other debts secured on it. A fee may be charged for mortgage advice. The exact amount will depend on your circumstances.

Sources:

Sky News https://news.sky.com/story/stamp-duty-rules-are-changing-from-april-heres-what-you-need-to-know-13322702

Latest news & breaking headlinesLatest news & breaking headlines+1Financial Times+1

https://www.stampdutycalculator.org.uk/

https://www.rightmove.co.uk/news/articles/property-news/stamp-duty-changes-mar25/